background

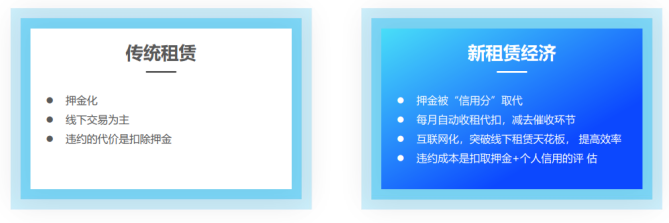

The "newness" of new leasing lies on the one hand in the internet-based leasing experience and on the other hand in the blessing of the "credit" system.

The new leasing economy is often called "credit leasing". In other words, leasing is a scenario that grows on top of the credit base.

The most obvious symptom is that the deposit exemption and lowering the user access threshold are the most obvious symptoms.

The background for the emergence of the new rental economy is consumption upgrading and overcapacity.

"Internetization + new credit system" are two prerequisites for rapid expansion of scale, improvement of user experience and overall transaction efficiency.

Credit-free new leasing solution

Big data risk control + face recognition + identity verification + Alipay withholding + smart contract withholding + Sesame Credit

+ Ant Shield risk control + E-signing electronic contract + SF electronic receipt + rental treasure certificate + picc order performance insurance + Winding

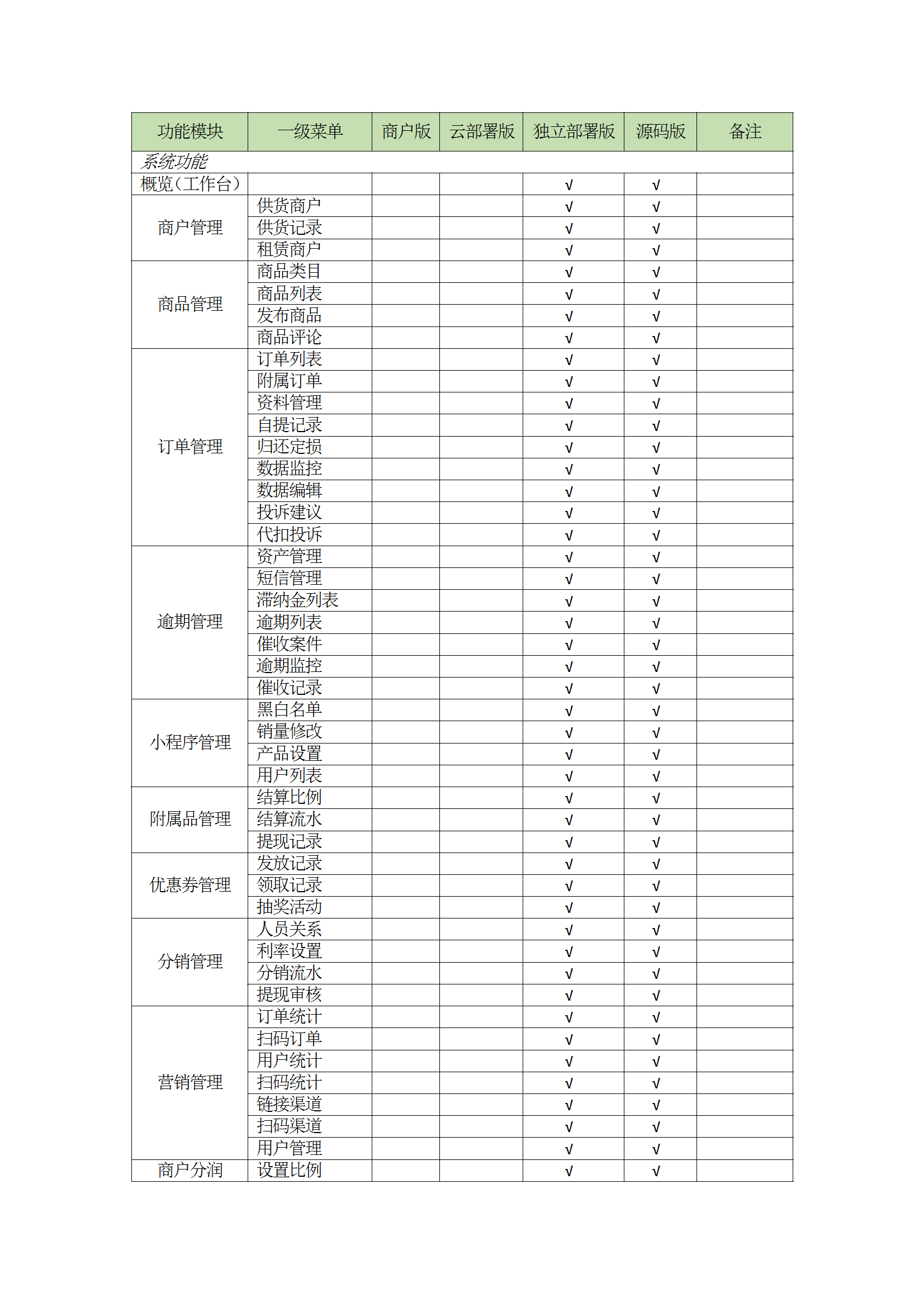

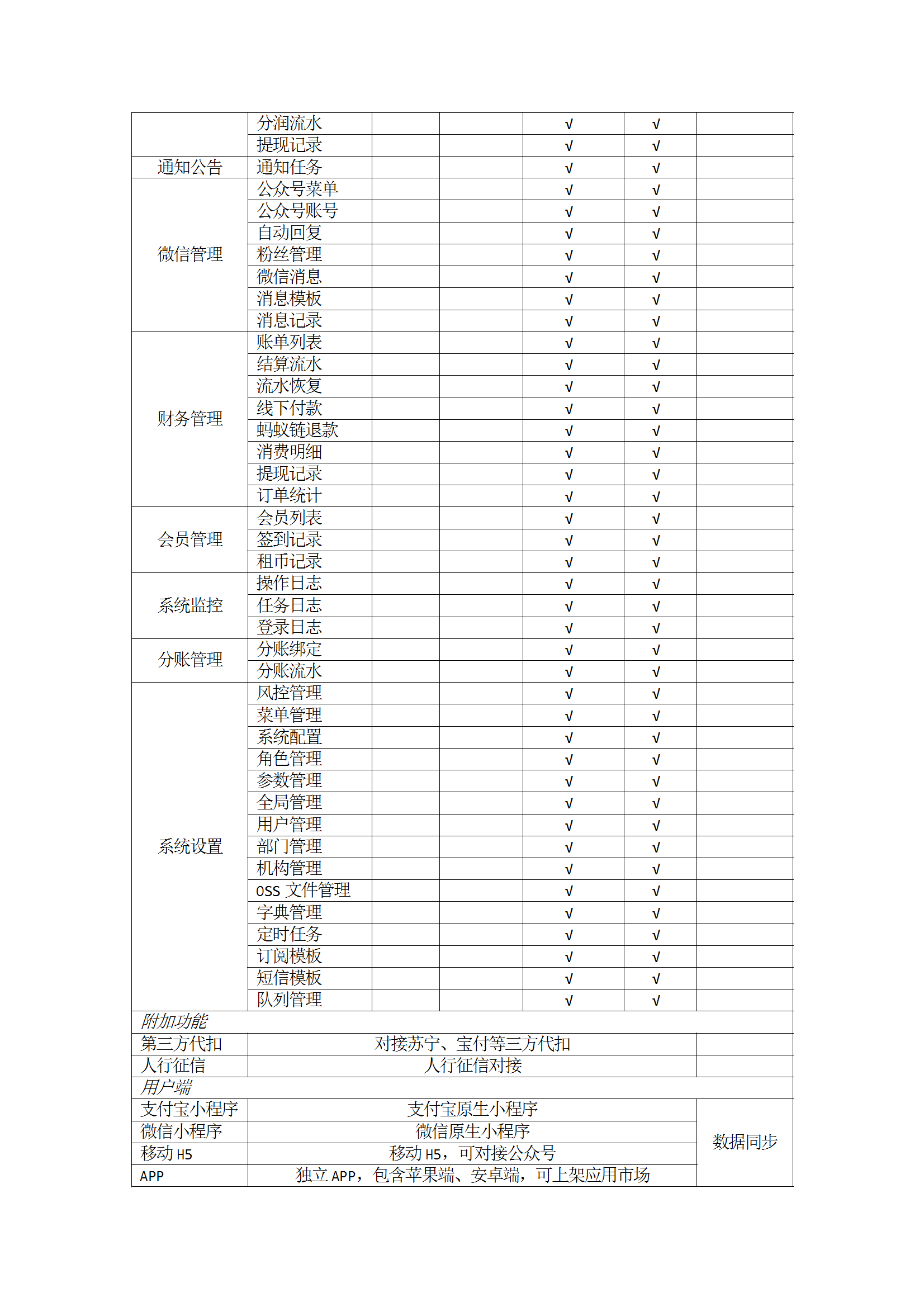

system introduction

Features

Credit assessment engine:

The system's built-in credit assessment engine uses artificial intelligence and big data technology to analyze the borrower's historical transactions, repayment records and social credit to quickly and accurately assess the borrower's credit rating.

Unsecured rental options:

The system provides a variety of leasing plans for users with different credit levels. These programs allow users to access funds based on credit scores rather than traditional physical asset collateral.

Automated contract management:

The system provides automated contract generation and management functions to ensure that all lease agreements comply with legal and regulatory requirements, and can track contract status in real time.

Payment and accounting processing:

The integrated payment gateway supports multiple payment methods to ensure the safe and rapid flow of funds. The accounting processing module ensures the accuracy and timeliness of all transaction records.

Risk monitoring and alert system:

Monitor leasing behavior and credit changes in real time, provide early warning of possible risky behaviors, and help managers adjust strategies in a timely manner to reduce losses.

Application scenarios

Equipment update for small and medium-sized enterprises: Small and medium-sized enterprises can lease new or updated equipment through the system to

support business expansion or technology upgrades without large initial investment.

Acquisition of high-value items for individual consumers: Individual users can use this system to rent high-value items such as cars and high-end electronic

products, and enjoy the latest technology without paying a high one-time purchase fee.

Security and Compliance

The credit mortgage-free leasing system strictly complies with data protection regulations, and all user data is encrypted and stored in a secure environment.

The system also conducts regular security audits to ensure the legality and safety of operations.

The credit mortgage-free leasing system not only improves the availability of funds, but also significantly lowers the entry barrier for users by removing

traditional mortgage requirements. The rollout of this system will help drive economic activity, especially among capital-poor small and medium-sized enterprises

and individual consumers. With this platform, users can manage their financial needs more flexibly and explore broader economic possibilities.